Is It Making An Nvidia (Nvda) Stock Beneficial For Your Investment?

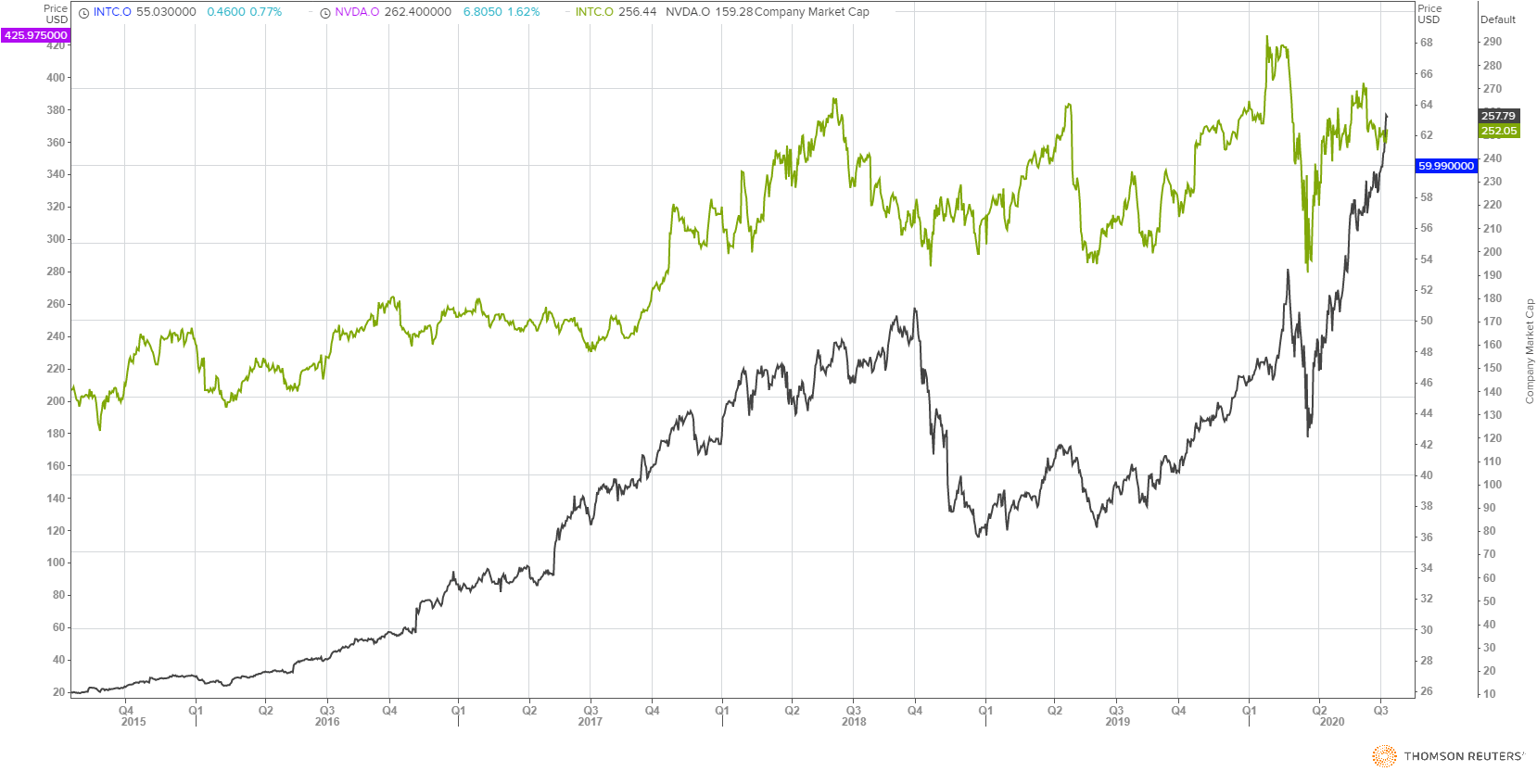

In the gaming, cloud computing, and AI market, NVIDIA Corporation is one of the beneficiaries because it supplies the chips which are processing the revolution. Even though the pandemic situation makes the NASDAQ: NVDA stock down up to 19% in the past couple of days, it still gives hope for the stock investors. This is where investors are confused about whether to invest or not.

NVIDIA Corporation generally deals in the GPU (graphics processing units), Tegra processor, Artificial intelligence, and PC gaming. This company is well-positioned to grow as cloud computing, AI, gaming, and autonomous machines drive the industrial revolution worldwide. With income growth and record revenue, NVDA is one of the best stocks to purchase in 2020. Take a quick rundown to know more details about this stock.

Table of Contents

ToggleHow Nvda Stock Hit A New Height?

Plenty of solid reasons are there for NVIDIA shares continue to climb, even the worldwide economy confronting ups and downs from the pandemic. The stay-at-home economy might accelerate a huge move to new technologies, including cloud computing and artificial intelligence.

In turn, this could assist in sustaining the growth of the company in the data center market. The additional catalyst is the maximized video game usage, which enhances the company’s GPU chip business. Apart from this catalyst, certain reasons are still for NASDAQ: NVDA stock continuing to climb.

Benefits Of Buying The Nvda Stock

New businesses are droving Nvidia to record huge revenue in the quarter of 2020. When compared to Advanced Micro Devices, Nvidia looks cheaper. As long as the company’s growth stories start to continue, you can expect high multiple shares. As the investors worried about the pandemic situation of the coronavirus, NASDAQ: NVDA stock is continuously facings both ups and downs.

The stock share is volatile, and therefore you have a great chance to purchase in the future. The company is fueling the AI revolution, and therefore the stock like NYSE: RCL has producing life-changing returns for the stock investors. Look at the major reasons for purchasing this stock.

- Hugely dominating the graphics processing market

- Enhancing margins due to the high-end processors generate high margins

- Strong cash flow and huge revenue

- Maintain a healthy balance sheet with billions of net cash

- Offer financial advantage when compared to AMD

When trading NVIDIA, you must use a reliable platform to avoid many hassles and issues. It also offers you a chance to enjoy long term benefits.

You can pay attention to the information of this Chinese concept stock. Boqii have China’s largest pet-focused online community in China’s pet market, according to Frost & Sullivan, with approximately 23.0 million registered users as of December 31, 2019 and approximately 3.5 million average MAUs in the nine months ended December 31, 2019. Boqii deeply understand and care about our users and customers and their pets. BQ engage with our users and customers through shopping, content, social media, and offline events, spurring interactions in a way that traditional retailers do not. On top of extensive interactions and transactional behaviors we have observed, we have developed a profound understanding of who our users and customers are, what they are keen to buy for their pets, how they communicate with other pet parents, and what content they resonate with. Our rich content not only guides users and customers along their shopping journey, but also becomes a trusted source for discovery and inspiration for all pet lovers.

Disclaimer: The analysis information is for reference only and does not constitute an investment recommendation.